AI avatars for financial services

Strengthen communication, compliance, and customer trust through real-time, two-way expressive conversations across banking, insurance, wealth management, and more.

How financial services uses Rapport

Strengthen customer communication and trust

Use role play about loans, claims, investments, and sensitive financial decisions—building clarity, confidence, and trust with clients.

Improve compliance and regulatory conversations

Employees can practice explaining disclosures, regulations, and scripts through guided simulations that reinforce accuracy and consistency.

Ensure consistent training across branches and teams

Create simulations once and deliver them anywhere so every advisor, banker, or agent follows the same communication and compliance.

Prepare reps for high-stakes moments

Simulations help staff handle escalations, fraud alerts, denied claims, and difficult customer interactions.

Upskill advisors on complex products

Role play helps advisors break down financial products, risk profiles, and policy details in a clear, compliant, client-friendly way.

Onboard faster with hands-on practice

New hires get simulations for sales calls, service scenarios, and account questions—helping them ramp faster and make fewer real-world mistakes.

Trusted by leading teams across industries

Customer stories

See Rapport in action

“

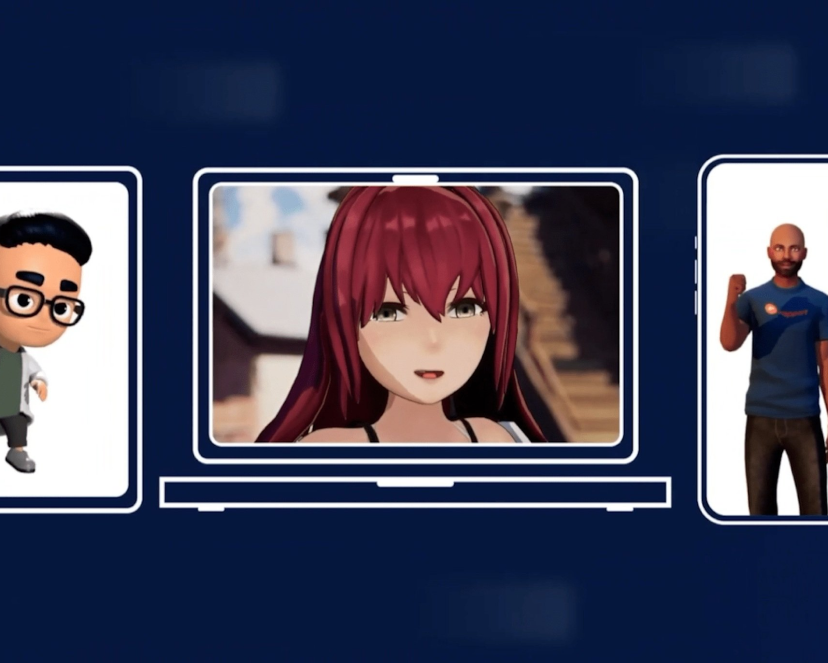

Of the systems we tested, Rapport was by far the easiest to use and connects seamlessly with a host of services. Rapport’s facial animation combined with its low latency and real-time responses helps us bring a new level of realism to our Virtual Humans creating truly immersive experiences.”

Nils Hellberg

CTO, Virti

See Rapport for financial services in action

You may also like

Stay in the loop with Rapport

Get the latest posts, product updates, and insights delivered to your inbox. No fluff, just the good stuff.